Here’s the latest advisory (small as it is) from CityWest as posted to their website (this is progress by the way, a communications company communicating with its subscriber base.

L M A O! love it, a little kid telling mig how to fix his issue LOL!

Open DNS + Untangle = great solutions ![]()

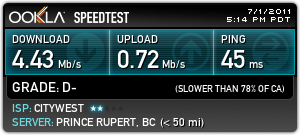

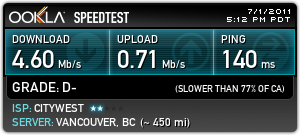

[quote=“mudduck9969”]http://www.speedtest.net/result/1366902316.png

Just came back…errhhh good as it gets[/quote]

Wow! I must live in the wrong part of town, Only got 1.89 on download.

Looks like it is fixed.

[quote=“jesus”]

I can see that the repairs to the severed fiber optic cable have not happened yet. Hopefully this will be done today.

Er isnt this internet thing like designed to route around damage and what not… perhaps a company that wants to charge leased line rates for their bandwidth should i dont know… invest in some sort of redundancy.

Personally I think the broken fiber is citywest attempting to place blame elsewhere as per usual whether it is in fact the cause or not. Regardless once again prince rupert citizens are not getting the service they pay for and subsidise with their tax dollars.[/quote]

Interesting that over the past six years this company has gone from contributing some 2 - 3 million dollars per year towards the city coffers to their latest performance in 2010 where they paid no dividends to the city at all.

When the city spun off the CityTel and Mobility assets to CityWest they were valued at $45 million dollars and the Company then proceeded to buy Monarch Cable for a further $23.7 million dollars. Since the inception of CityWest, they’ve not invested in their own wireless operations but have outsourced mobility to Northwestel/Bell and spent a further $21.6 million dollars on cable and other plant infrastructure at a time when the world is moving to wireless. These management decisions have not added value to the company and in 2008 we witnessed a $21 million dollar write down in the value of the company and the city forgiving a $20 million dollar loan to CityWest.

In 2005 their lender (HSBC) lent them the money to buy Monarch at a rate of Prime plus .25%. The HSBC has apparently recognized the risk in this company has increased significantly and has raised the rate they charge CityWest from prime plus .25 to prime plus 1.25. Banks generally raise rates when they see the risk profile of a customer has deteriorated. At the present time the HSBC rate would be 4.25%.

Council and the company has refused to disclose detailed financial information on the operation of the company and how their strategy has played out over the years since it was spun off to be “An Arms Length” corporation. We really have no idea on what the present value of the company is.

What we do know is that in 2010 the company did not pay any dividend to the city after it experienced a 34% drop in net earnings in one year. In 2010 the company recorded net income of 2.6 million dollars versus 3.9 million dollars in 2009.

While a new CEO has come on board and has made some very striking observations, these issues have been there since the outset of CityWest and were well known to the CityWest board and management. The fact they were not dealt with under Rob Brown is not only a reflection of his management but also the ineffective governance oversight that that the City and the board has provided this company.

Frankly the City Council needs to do two things

1 Fire the Chair and the Board so the new CEO has the support he will need to make improvements in the financial operation of this company.

2. Ask it’s citizens whether owning a company in a high risk and competitive industry is the business a financially struggling municipality should be in. The citizens need to understand the risks to their remaining equity in the company and should be asked if they are prepared to pay the taxes necessary to support this company.

This opportunity to decide whether they wanted to expand into regional telecommunications using municipal monies was denied them by Pond and Kumar when they used a “Counter Petition” to divest the municipality of the CityTel Assets and to avoid going to a referendum on the monies that needed to be borrowed to buy Monarch Cable. At the time Cityite was spun off, we were assured that there would be no impact on our taxes and it would be interesting to see how the company performed as compared to the original five year projections that would have been prepared in 2005.

Note that when you invest in a high risk investment, you generally expect to receive a much greater rate of return that you would in a fully secured situation. The HSBC being fully secured is getting 4.25% on its investment and I’d say the City should be achieving at least 7% considering we stand to lose everything if competition crushes City West over the next few years. Essentially depending on the value of CityWest, instead of ZERO the city should be obtaining an annual return of between $1.4 million and $3.5 million on it’s investment in CityWest.

-------------------------------Rate of Return

Asset Value----------------- 4.25%---------------- 7.00%

Twenty Million-------------$850,000--------------$1,400,000

Thirty Million------------$1,275,000--------------$2,100,000

Forty Million-----------$1,700,000--------------$2,800,000

Fifty Million--------------$2,125,000--------------$3,500,000

As we all troop down to City Hall on Monday to pay some of the highest municipal taxes in BC, take a moment to reflect what your tax bill would look like if you were not subsidizing a failing company to the tune of 1.4 million to 3.5 million dollars annually. As for the shitty operational performance of this company, it’s only a matter of time before this becomes a mute point as they won’t be financially viable.